Real estate market in HCMC – Q3 2021

Due to the prolonged social distancing and severe policies of Government to prevent Covid-19, the real estate market in HCMC in particular and Vietnam’s economy in general has been remarkably affected. A lot of stores were forced to close and transactions were suspended. The below article will show you a clearer perspective about this overall picture.

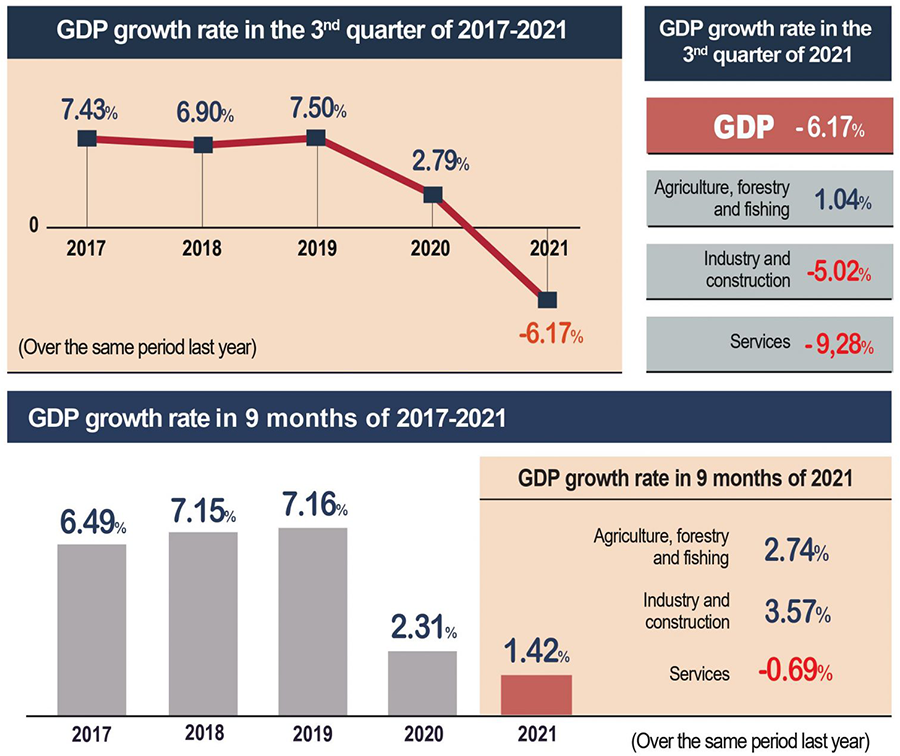

Vietnam’s economic overall

In Q3/2021, Covid-19 and long lockdowns decreased consumption and investment, limiting Vietnam’s growth prospects. Generally, GDP in the third quarter of 2021 got a reduction of 6.2% yoy. This has been the deepest decrease of GDP since Vietnam calculated and announced quarterly GDP up to now. Average CPI in 9 months of 2021 increased by 1.82% compared to the average yoy.

Facing to the negative impacts of the epidemic, the economy still recorded bright spots when registered FDI achieved 22.15 million USD, rising by 4.4% yoy. For the first 9 months of 2021, the total export and import turnover of goods still remained a high growth rate, reaching 483.17 million USD, up 24.4% yoy. In which, exports increased by 18.8%, a rise of 30.5% for import.

Vietnam’s real estate market

Vietnam’s real estate market

With the prolonged impacts of the 4th epidemic outbreak, many provinces/cities had to carry out the social distancing, which affects transactions in the market significantly.

In August 2021, the national average interest level recorded was 30% compared to its peak in March 2021. In which, HCMC recorded the deepest decrease of 50%, followed by Da Nang 48%, Ha Noi 29%.

Entering September with signals that Covid-19 was gradually being controlled and the vaccination rate increased rapidly in big cities, the real estate market quickly showed positive signs, with the recovery of interest level by 55% compared to March 2021.

Real estate market in HCMC

Real estate market in HCMC

HCMC is the market that is affected the most significantly in the fourth outbreak of Covid-19 when almost all transactions were suspended throughout the city. The interest level in Q3/2021 was only 30% compared to March 2021, down 50% compared to the second quarter. In which, the largest decrease belonged to the type of land plots (down 62%), private houses (down 55%), apartments (down 41%).

The quantity of posts for sales also dropped remarkably, with a decrease of 81% qoq. However, the price for sales still continuously went up in 9 months of 2021, especially in apartments, private houses and townhouses, with the average increase from 2-4% yoy. Meanwhile, private houses and townhouses in some districts was still at a high growth rate such as District 2 (up 13-15%), District 9 (up 15-20%).

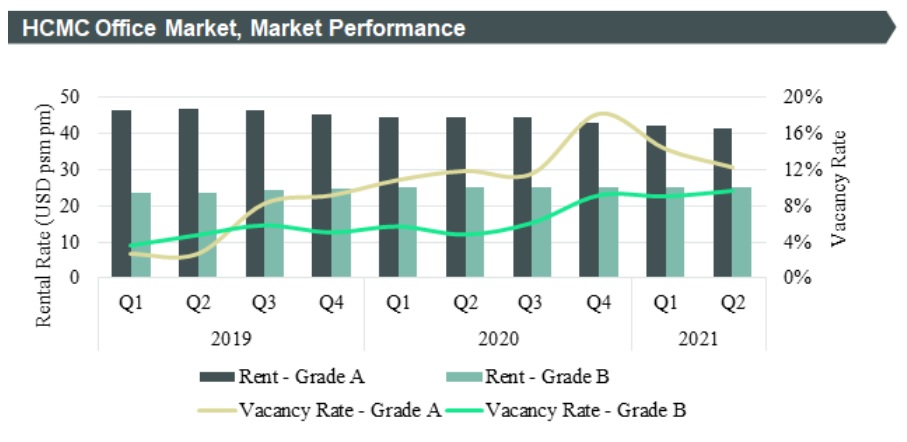

OFFICE MARKET

In the third quarter of 2021, the market of office for lease in HCMC had no new projects. HCMC has just undergone 120 days of anti-epidemic under Directive 16 and most people were forced to work from home. Most landlords had policies to support tenants such as discounting 50% on rent and service fee for office tenants or re-signing the leasing contract with a lower increase than the pre-epidemic period.

The number of office leasing transaction was estimated to decline about 30% compared to the average of the previous 2 quarters and were mainly transaction of office relocation. Office relocation transactions accounted for over 40% of total transactions in the quarter.

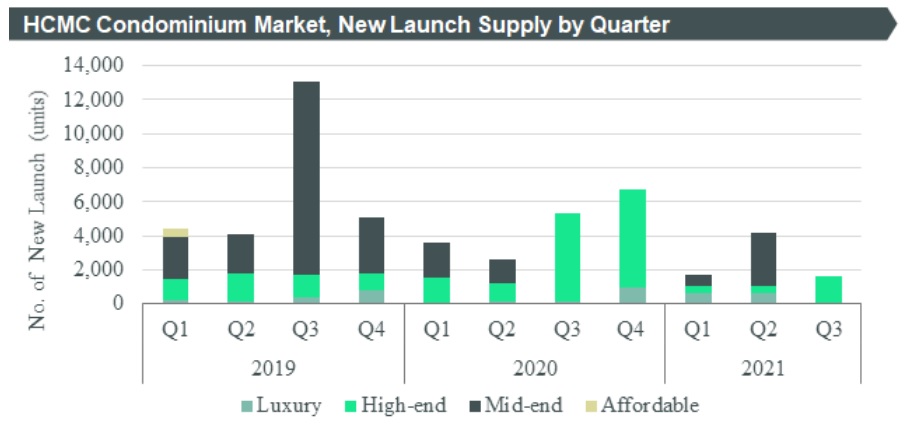

CONDOMINIUM MARKET

During the third quarter, only 2 projects in the high-end segment opened for sale via online sales channel. Restrictions when conducting real estate transactions online as well as cautious psychology of both investors and customers caused new supply to fall to the lowest level over the past 3 years, with 1,600 apartments, equivalent to around 40% qoq. However, despite of conducting sales online, the selling rate of 2 new launched units was still very positive, achieving 82%; in which Binh Tan District first appeared a project in the high-end segment.

The sold quantity in Q3/2021 got 1,582 units, down 62% yoy because of the decrease of supply. Similarly, the first 9 months of 2021 recorded 8,956 sold units, down 17% yoy.

TOWNHOUSE AND VILLA MARKET

New supply continued to be scarce due to investors were cautious in launching projects amid the fourth Covid wave.

In Q3/2021, the mainland real estate market in HCMC continuously caught interest from buyers. Faced to the impact of lockdown and social distancing, buyers were increasingly interested in complex projects with a variety of internal utilities. Non-CBD districts will continue to attract buyers, promoting demand to neighboring provinces such as Dong Nai, Binh Duong and Long An.

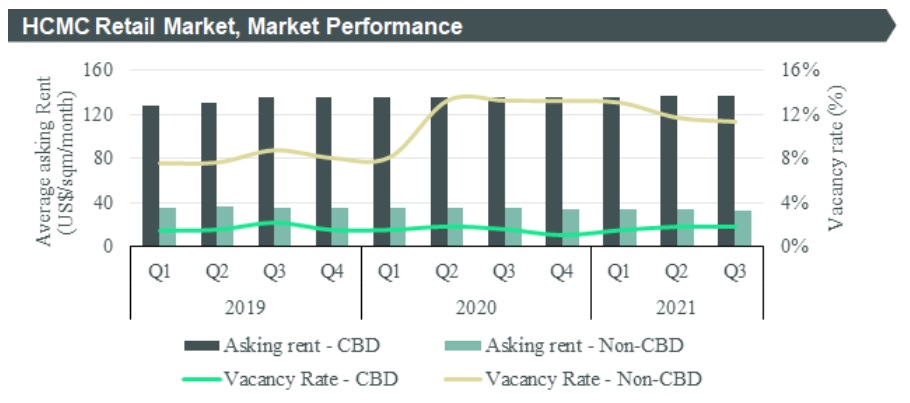

RETAIL MARKET

COVID-19 outbreak has caused all shopping malls to close since the beginning of June. Most were considering reopening in October 2021 along with safe conditions for epidemic prevention as well as the possibility of reducing open time. Entertainment sectors hasn’t had new notice for reopening. The existing tenants were rental free during the period of applying Directive 16 of Government.

In Q3/2021, there was no new supply and the total retail supply in HCMC remained at 1,068,128 sqm. The rental rate in CBD was still 137 USD/sqm/month and its in Non-CBD dropped by 3.8% qoq, reaching 32.6 USD/sqm/month. The reason was the investors actively offered preferential rates for vacant spaces.

(Reference source: CBRE Vietnam, batdongsan)

You may concern:

Real estate market in HCMC – Q1 2021

Real estate market in HCMC – Q2 2021

Dennis

Vietnam’s real estate market

Vietnam’s real estate market Real estate market in HCMC

Real estate market in HCMC