Real estate market in HCMC – Q2 2021

In the context of Covid-19 returning in the fourth time and having a record number of infections, real estate market in HCMC in particular and in Vietnam in general marked a positive recovery. Follow this article to have a clearer view of real estate market in HCMC in the second quarter in 2021!

Vietnam’s economic overview

Q2/2021 witnessed a strong recovery of Vietnam’s economy when GDP growth rate reached 6.6% and the consumer price index was restrained at 1.47%. This growth came from increasing exports of electronic products. Export value in Q2/2021 increased 28% yoy. Besides, real estate market in Q2/2021 also saw the number of newly established businesses rose by 45%, the registered capital by 24% and the registered employees by 46%.

Real estate market in HCMC in Q2/2021

Real estate market in HCMC in Q2/2021

OFFICE MARKET

In Q2/2021, rental office market in HCMC welcomed another grade B project which was AP Tower in Binh Thanh District, adding 10,841 sqm to the total market supply. As of Q2/2021, the total supply achieved 1,433,327 sqm of leased area from 18 grade A projects and 69 grade B projects.

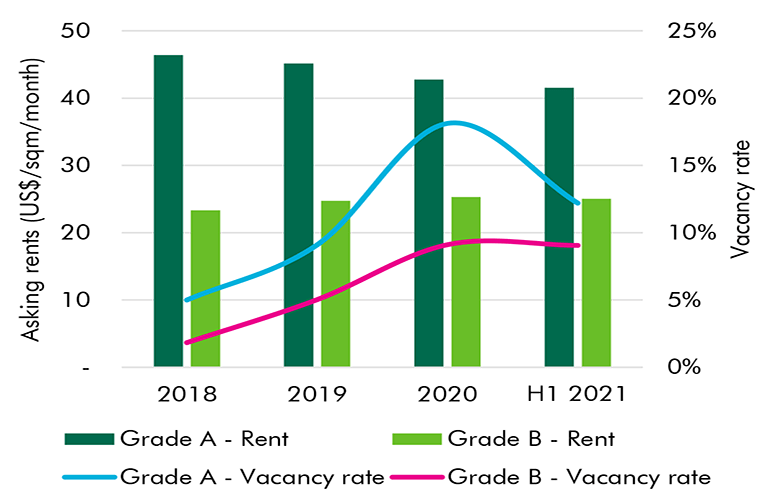

In terms of market performance, grade A vacancy rate continuously reduced by 2 ppt qoq. It’s mainly due to new buildings in District 1 and District 7 with high quality and near to existing office clusters. In grade B segment, the vacancy rate was stable and the market saw many tenants returning old premises to move to newer projects in Tan Binh District, District 1, District 2, District 7 and Binh Thanh District. As of Q2/2021, the vacancy rate in grade A and grade B segment reached 12.2% (up 0.4 ppt yoy) and 9.1% (up 4.3 ppt yoy) respectively.

Towards rents, the downward trend in grade A segment slowed down and dropped 1.2% qoq while rents in grade B remained stable. The rents in grade A and grade B segments were 41.6 USD/sqm/month (down 6.4% yoy) and 25.1 USD/sqm/month (down 10% yoy) respectively. Total net absorption in the quarter was positive. In the first 6 months of 2021, it gained over 33,300 sqm.

Based on CBRE’s transaction statistics, lease renewals and open transaction accounted for 82% of total transaction in the quarter. Accounting for more than 78% of total transaction area, 4 industries with the most positive transactions included Information Technology, Finance/Banking, Logistics and Retail/Commerce/E-commerce.

In the half of 2021, the market is expected to welcome 3 more grade B projects with total NLA of 34,500 sqm. From 2022 onwards, the market will have more grade A supply, typically Etown 6, One Central projects as well as office projects in Thu Thiem New Urban Area.

RETAIL MARKET

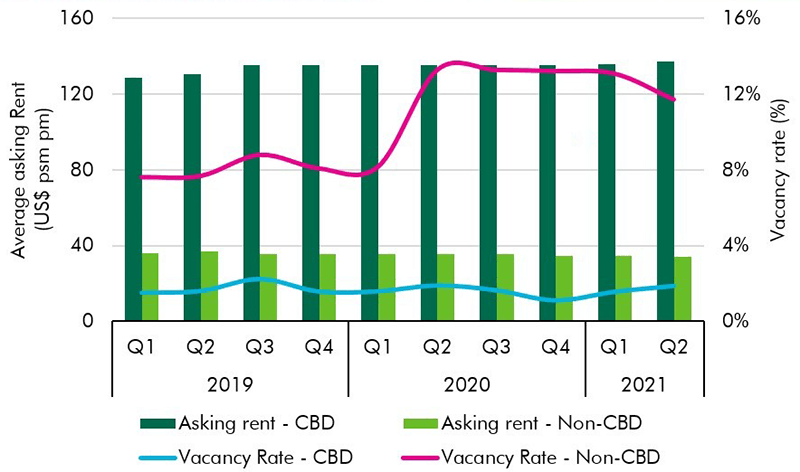

In Q2/2021, Coopmart Truong Chinh in Tan Phu District was opened with 16,000 sqm. After some quarters without new supply, as of Q2/2021, total retail supply in HCMC reached 1,068,128 sqm NLA. The new Covid-19 outbreak was the reason for all shopping malls forced to close from the beginning of June, except essential categories such as supermarkets and pharmacies. However, this directive will be more stringent in Q3/2021 with the rapid increase of new infections and difficult-to-control new variants.

In Q2 2021, the vacancy rate in the non-CBD areas fell by 1.4 ppt qoq. As of Q2/2021, the vacancy rate in CBD and non-CBD areas respectively were 1.87% (the same yoy) and 11.71% (down 1.7 ppt yoy). In June 2021, all shopping centers applied rental and service free for closed businesses. Some landlords also actively reduced the rent by 10-50% in May, depending on the industry.

As of Q2/2021, rents in the CBD gained 137.1 USD/sqm/month, up 1.1% qoq (up 1.2% yoy). Rents in the non-CBD gained 33.9 USD/sqm/month, down 2.3% qoq (down 5.2% yoy).

Big businesses have had their own activities to prepare during the epidemic and will bring many profits when the economy gets recovery. Typically, Masan bought 20% stake from Phuc Long coffee chain for their new combination model – convenient store/coffee/bank. Small businesses, on the other hand, continued to wait and cut the expenses and combined with shifting to an online platform – a future trend. According to Euromonitor, e-commerce sales in Vietnam can grow double in the next five years.

The market is expected to have more 200,000 sqm of retail area from now to 2023, including the CBD and non-CBD. In the short-term, categories such as F&B, coffee chain, convenience store, health & beauty will be continuously expanded, mainly retails podiums at residential blocks before the market has more shopping centers supply. The market sentiment as well as consumer confidence will be recovered rapidly once the epidemic is under control and national vaccination rate is improved.

CONDOMINIUM MARKET

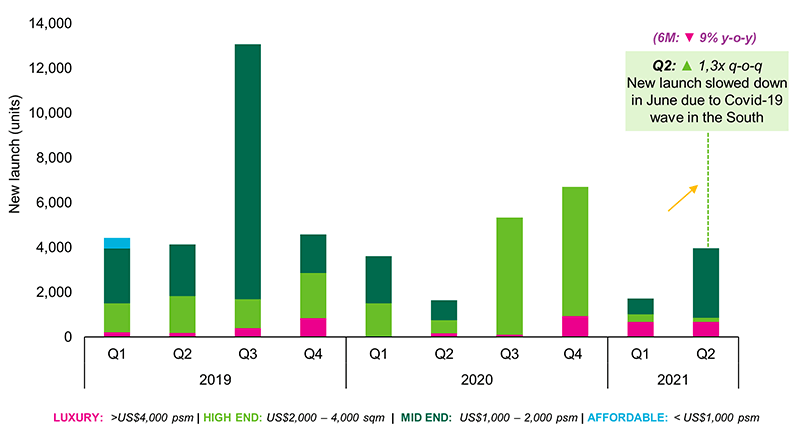

In Q2/2021, HCMC market received 3,968 units for sale. This number was double that of the previous quarter and showed an improvement in sales. Yet, with 5,600 units, total launched supply in half of 2021 was still 9% lower yoy because of the Covid-19 resurgence. By segment, the mid-end segment accounted for 79% of the supply in Q2/2021, with the rest coming from the luxury and high-end segments.

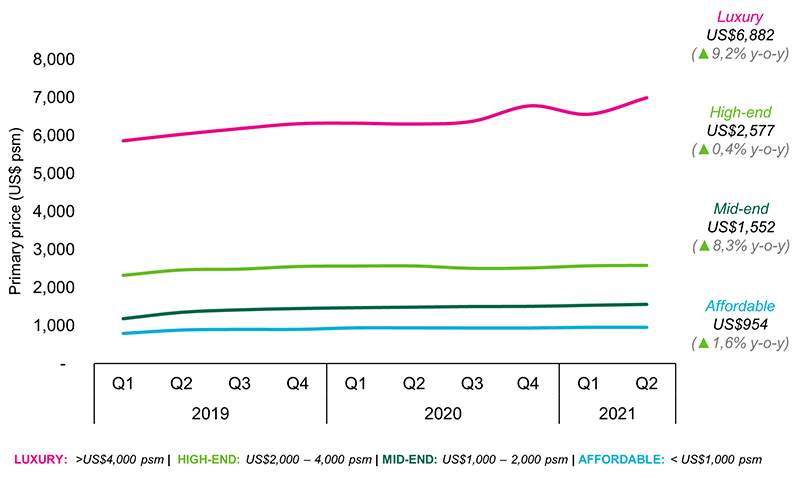

Average selling price in the primary market increased in all segments, reaching 2,260 USD/sqm (VAT excluded), up 16.5% yoy. The average price climbed significantly due to the lack of supply in the mid-end and luxury segments receiving the branded product line (Branded Residence). The high-end and affordable segments had a slight rise in the survey quarter, respectively 0.4% and 1.6% yoy.

Primary prices in segments in 2021 will be from 1% – 4% compared to 2020. Particularly, the price of luxury units is expected to grow by 6% in 2021 and 2022 thanks to new products – Branded Residence in District 1.

(Reference source: CBRE Vietnam)

You may concern:

Real estate market in HCMC – Q1 2021

The situation of rental real estate market in 2021

Dennis

Real estate market in HCMC in Q2/2021

Real estate market in HCMC in Q2/2021