Real estate market in HCMC – Q1 2021

In the first months of 2021, the real estate market in HCMC gradually covered. In the first quarter of 2021, the quantity of successful real estate transaction was only 86% compared to the previous quarter. However, the selling price continuously increase in most segments, from apartments to villas, townhouses,…

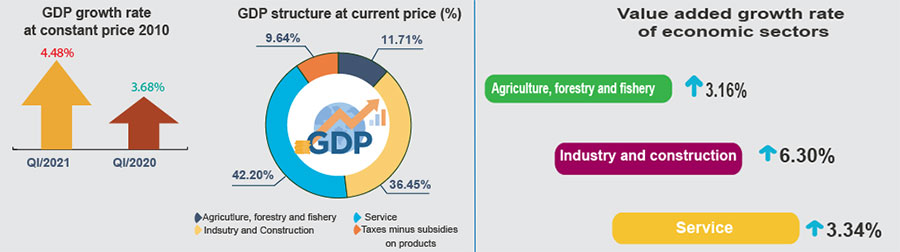

General economic situation of Vietnam

Vietnam’s economic situation in the first quarter of 2021 has many bright points. Gross Domestic Product (GDP) – Q1/2021 is estimated to increase by 4.48% over the same period last year, higher than the growth rate of 3.68% in the first quarter of 2020. It shows that the adaptation, resilience and recovery trend of the economy is increasing. According to a survey by the General Statistics Office, 51% of businesses surveyed believe that the economy will continue to improve in Q2/2021.

Besides, Vietnam’s export and import also get an increase of 22% and 26% respectively. This result is thanks to the impact of the Free Trade Agreements that Vietnam has joined in recent years. The amount of FDI registered in Vietnam in Q1/2021 also increased by 18.5%. Although the number of newly registered business decreased by 1.4%, the number of newly established real estate business increased sharply by 27%. This marks the market’s recovery this year.

Real estate market in HCMC in the first quarter of 2021

Real estate market in HCMC in the first quarter of 2021

In the context of facing to difficulties, challenges because of the epidemic, natural disasters and being decreased the demand significantly, real estate industry still has a positive contribution towards economic growth, creating an indirectly strong motivation spread such as capital, land, material, construction and so on. The real estate market maintains a relatively stable development through the criteria of stable supply; more appropriate product structure, maintained transaction quantity, increasing property price.

In order to visualize the market overview in the first quarter of 2021, it is necessary to take a look at important indicators. The number of licensed housing projects rose by nearly 8%, ongoing projects by nearly 3%, completed projects by 8.7% compared to the fourth quarter of 2020, in which the projects of licensed tourism and resorts have a higher growth rate. In terms of total successful real estate transaction volume, this volume has a downward trend due to the impact of the Lunar New Year holiday, only about 66% compared to the fourth quarter of 2020.

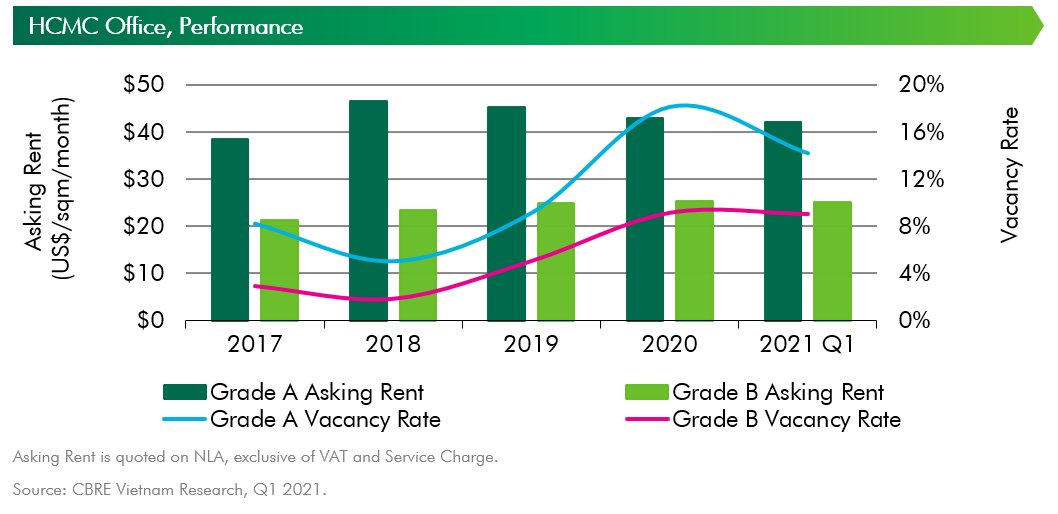

OFFICE MARKET

In the first quarter of 2021, office market in HCMC had no new supply. By the end of Q1/2021, total office supply remained at 1,422,486 sqm from 18 Grade-A buildings and 68 Grade-B buildings.

It is predicted that there will be more 74,000 sqm of new office space coming from 5 Grade-B buildings in the city in 2021, namely AP Tower, Pearl 5 Tower, Cobi Tower, The Graces, Saigon First House. In 2022, the new city office market will have a new supply of Grade-A office space.

RETAIL MARKET

RETAIL MARKET

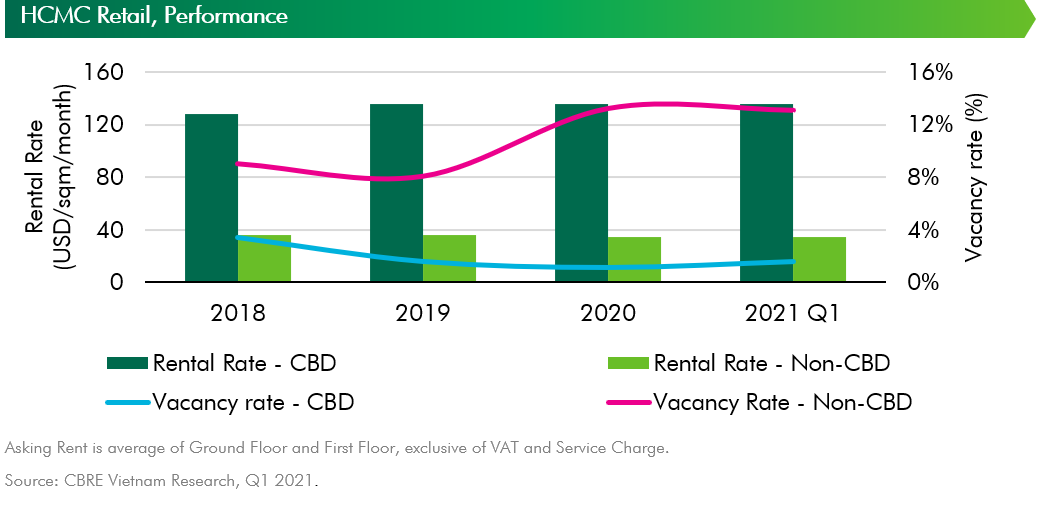

HCMC retail market also had no new supply in the first quarter of 2021. As the end of the quarter, total supply kept at 1,049,023 sqm of net leased area.

In HCMC, total revenue achieved a growth of 6.2% quarter-to-quarter, higher than the negative growth of 1.3% in 2020. On average, the leasing price has returned as the pre-Covid period and most investors will wait for the market to recover before rising again.

CONDOMINIUM MARKET

CONDOMINIUM MARKET

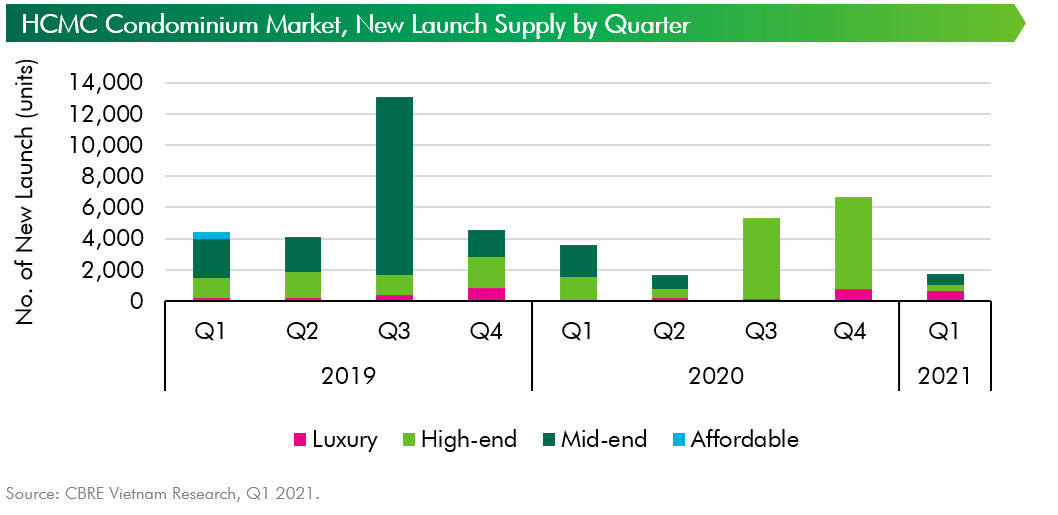

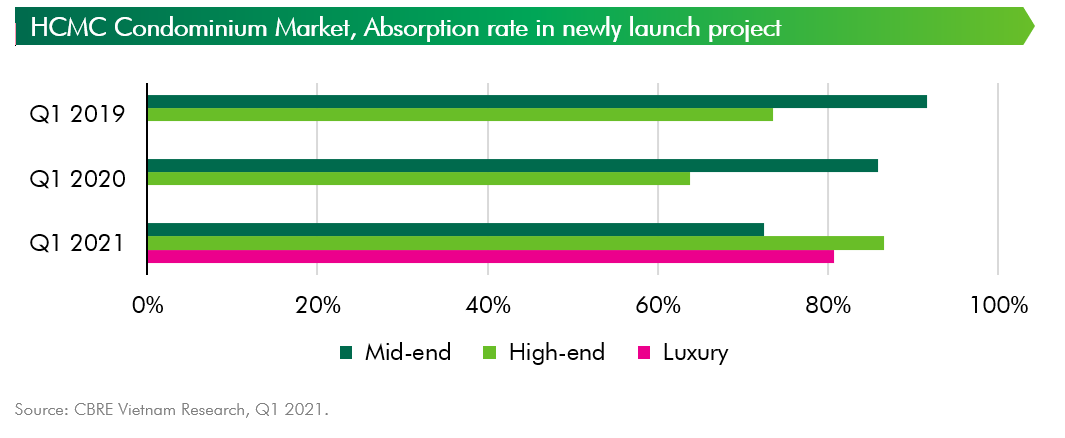

In Q1/2021, the offered supply was recorded at 1,709 units, a reduction of 74% qoq and 53% yoy. This is one of quarters having the lowest supply in the past three years.

In terms of new supply, high-end and luxury projects continued to lead the market while mid-end and affordable segments were limited. The mid-end segment accounted for 41% while this segment occupied about 55% – 60% of the total supply in previous years. The luxury segment ranked second, getting 39%. The high-end segment accounted for 20% and there was no new supply in the affordable segment in the quarter.

In terms of location, the supply rate is as bellow:

- The East area accounted for 47%

- The South area accounted for 36%

- The West area accounted for 14%

- The central area accounted for 3% of the total supply. The central one has had very little supply over the past three years due to land constraints and licensing issues.

In 2021, there will be forecasted no desirable change, however, the market will be improved compared to the previous year. It is expected to welcome about 17,500 units with new projects in suburban districts such as District 9, District 12, Binh Tan District, Nha Be District.

Primary price in 2021 will increase by 1% – 4% compared to in 2020. In particular, prices of luxury apartment is expected to grow by 2% – 7% in 2021 and 2022 thanks to the new product which is the first luxury branded apartment – Grand Marina (Branded Residence) in District 1. Expected sold units will achieve 15,700 and 19,400 apartments in 2021 and 2022.

(Reference source: Tapchicongthuong, CBRE, Department of Construction)

Dennis

Real estate market in HCMC in the first quarter of 2021

Real estate market in HCMC in the first quarter of 2021 RETAIL MARKET

RETAIL MARKET CONDOMINIUM MARKET

CONDOMINIUM MARKET